Year: 2020

Top Quantum Computing Companies to look out for in 2020

Top Quantum computing companies to look out for in 2020

SHARE

Quantum Computing was the unexpected highlight of India’s Union Budget 2020, when Nirmala Sitharaman, the Finance Minister, allocated INR 8000 crore towards the National Mission on the applications of Quantum Computing in India.

India also has a major interest in Quantum Computing. Therefore, we have enlisted the top Quantum Computing Companies to look out for in 2020.

- Google Research

Google Research has opened a Quantum Artificial Intelligence Lab with the help of a joint collaboration among the NASA Space Research Association, whose goal is to pioneer research on how quantum computing might help with the help of machine learning and some other computer science problems.

- IBM

IBM is a trusted partner to help you start the journey of quantum computing and prepare for the modern era of quantum advantage. You can discover some of the use cases, equip your organizations with some of the practical knowledge of quantum skills, and access world-class expertise and technology to advance in the field of quantum computing.

IBM Quantum helps you to be the primary to explore, benefit, and outline from the chop-fast approaching age of quantum computing. As a basically completely different manner of computation, quantum computing might doubtless remodel the companies and societies.

- Intel

Intel, which is known as one of the best technology companies across the globe, has invested around $50 million in funding to QuTech in the year 2018. During the CES Conference in 2018, Intel also revealed that it had created a 49-QuBit chip called Tangle Lake, one of the most significant innovations ever made in the development of Intel Chip.

- Microsoft

Microsoft, which is another most prominent market leader in the ecosystem of quantum computing. The team of Microsoft has started exploring the benefits of quantum computing in 2018. Moreover, they focused on the design of solutions for use in a fault-tolerant and scalable computing environment. In 2019, Microsoft had revealed that it was researching the area of topical computing. This helps to improve the engineering of quantum states. Microsoft has also made some of the significant steps towards improving the development layer of quantum computing.

- Alibaba Cloud (Aliyun)

Alibaba Cloud, in partnership with the Chinese Academy of Science, has invested in the Quantum computing research by the establishment of Alibaba Quantum Laboratory. They are leading the race of quantum computing in China. Their areas of R&D include the quantum processors, quantum algorithms, and quantum systems.

- D-Wave Solutions

D-Wave Solutions is a company that is specializing in the delivery and development of quantum computing systems. Its quantum computers are highly designed to solve the problems of machine learning, optimization, and sample problems that have information volumes and complexity that overwhelm the ability of conventional computers to derive timely, accurate, and actionable knowledge.

- Lockheed Martin

Lockheed, in collaboration with the University of Southern California, founded the Lockheed Martin Quantum Computation Center. The center is highly focused on harnessing the power of adiabatic quantum computing, in which the issues are encoded into the lowest energy state of a physical quantum system to find the optimum answer to some of the specific questions with many variables.

- Honeywell

Honeywell is one of the significant pioneers in the field of the quantum computing landscape. The company started its adventure in the year 2014 at the time of practicing in an advanced intelligent research project to investigate the latest technology.

Honeywell focuses more on a concept called trapped ion quantum computing. This approach uses the ion suspended in space to transmit information with the help of movement of those ions.

- Rigetti

Rigetti Computing is a full-stack quantum computing company that develop and manufacture superconducting quantum integrated circuits and package and deploy those chips in a low-temperature environment, and build control systems to perform quantum logic operations on them.

- IONQ

IONQ is a world-leading general-purpose quantum information processor. The unique trapped ion approach, a combination of perfect qubit replication, unmatched physical performance, optical networkability, and highly optimized algorithms to create a quantum computer that is powerful as well as scalable and that will too support a broad way of applications across different segments and industries.

- Amazon Braket

Amazon Braket is a fully managed service that helps you to get started with quantum computing by offering a development ecosystem to design and explore quantum algorithms, run and test them on simulated quantum computers on your choice of different quantum hardware technologies.

- Baidu

Baidu has launched its own Institute for Quantum Computing dedicated to the application of Quantum Computing software and Information Technology.

Professor Duan Runyao headed the Baidu Quantum Computing Institute, who is also the director for the Quantum Software and Information at the University of Technology Sydney.

At the time of launch, Professor Duan revealed that his plan is to make Baidu’s Quantum Computing Institute into a world-class institution within the time period of five years. In the coming five years, it will integrate Quantum Computing into the Baidu business plan.

- Toshiba

Toshiba offers a Toshiba’s quantum key distribution system that delivers digital keys for cryptographic applications on fiber-based computer networks.

Moreover, in the year 2015, the company announced that genome data from Toshiba’s life Science Analysis center was slated to be encrypted by a Quantum communication system.

- 1QB Information Technologies

1QBit is a software company for quantum computers which is having its specialization in developing applications for the finance and banking industry, working with industry partners it produces custom solutions to solve real-life problems exhibiting high degrees of computational complexity.

- Accenture

Accenture Labs is working on the quantum computing ecosystem and collaborating with leading companies such as 1QBit and Vancouver. The company platform enables the development of hardware-agnostic applications that are compatible with boost quantum and classical processors.

SHARE

RECENT POSTS

-

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR -

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR -

Emerge 2020 HR Tech Summit12 Jul 2020 PR

Emerge 2020 HR Tech Summit12 Jul 2020 PR -

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles -

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

How is Blockchain Revolutionizing The BFSI Sector ?

How is Blockchain Revolutionizing the BFSI Sector ?

SHARE

Blockchain technology drives tremendous changes across the BFSI industry. The decentralized financial services have brought up huge improvements to the centralized banking system.

So, let’s have a look at some of the major use cases of the blockchain technology in the BFSI sector:

- Know Your Customer (KYC)

Banking and financial institutions are highly concerned about the increasing costs that they have to bear to comply with the KYC. It is a lot of time-consuming processes; and it has to be performed individually by all banks and money based institutions. Nowadays, the banks need to upload the customer KYC data into a central repository to check the information of an existing or new customer.

With the help of a blockchain technology system, independent verification of each customer by one financial organization can be accessible for other organizations so that the one does not have to restart the KYC process again.

- Auditing and Bookkeeping

Standardizing the financial statement with the help of blockchain technology allows the auditors to verify the most crucial data easily and gradually. This decreases costs and even helps to save a lot of time. Blockchain technology makes it much more possible to prove the integrity of electronic files.

- Smart Contracts

The smart contract is a series of code, which runs when certain conditions written on it are completed.

With the help of smart contracts for banking, financial transactions help increase the speed of the complex processes. This also helps to make sure the accuracy of transferring the information as the transaction will be approved only if all the written conditions of the code are met.

- Digital Identity Verification

Identity verification is a significant part of each and every transaction that is made with your debit card or at your local bank branch. Your identity is indirectly linked to your assets.

- Fraud Reduction

The involvement of money in any circumstances increases the chances of fraudulent activities. Around 40% of the financial bodies are susceptible to heavy losses relating to economic crimes. The reason behind this can be the usage of a centralized database system for both the money and operations management. Blockchain is a secure, non-corruptible technology that works on a distributed database system. Therefore, there is no such chance of a single point of failure. All the transactions are stored in the form of a block with the help of a cryptographic mechanism that is very difficult to corrupt. Using blockchain technology can help to eliminate the cyber-crimes and attacks on the financial sector.

- Syndicated loans lending

There is one area of banking where the multiple institutions have come together to form consortiums to facilitate blockchain. Credit Suisse is one of those 20 big institutions, which are as of now working towards putting syndicated lending on the blockchain with the distributed ledger technology, more commonly known as the blockchain technology. As of now, this is an area that is still quite behind in terms of technology used. Fax communications, large delays in getting loans, and other hurdles are faced at the time of making and processing syndicate loans.

- Global payment options

Blockchain’s latest technology is internet-based and does not need any of the specific setups of operating users can access the data and conduct different transactions across the globe using their account public and private keys.

- Blockchain security

The first priority for any financial institution is in the area of security and privacy. And given the right and popular security patterns blockchain holds, most banks are obviously going to use this in storing assets that are of extreme value.

- Blockchain with AI

Banks do have a lot of tasks to process daily. And given that blockchain is now incorporated with Artificial Intelligence, most financial institutions will certainly want to use this because it will help in reducing their work stress and the rest. This will cover tasks like data storage, data monetization, and so on.

To Sum Up

This unique technology offers the banking industry with many unique opportunities, but certain challenges must be overcome for noticeable impacts to occur in the banking sector.

More so, the need for regulatory functions and oversight needs to be highly addressed by some of the relevant authorities. The financial sectors are synonymous with huge amounts of data. Moreover, data scalability must be sorted out prior to deploying blockchain in the financial sector.

In summary, blockchain can impact and revolutionize the banking financial sector. The only thing needed is its right application and feasibility.

SHARE

RECENT POSTS

-

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR -

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR -

Emerge 2020 HR Tech Summit12 Jul 2020 PR

Emerge 2020 HR Tech Summit12 Jul 2020 PR -

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles -

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Rapid Adoption of Blockchain Could Transform Emerging Economies into Financial Juggernauts – A Perspective

Rapid Adoption of Blockchain Could Transform Emerging Economies into Financial Juggernauts – A Perspective

Author - Vijay Kumar, Founder of DigitalFort Technologies

SHARE

A blockchain disruption is awaiting to unfold. While blockchain’s adoption would enforce transparency, security, regulatory compliance, robustness, non-repudiation, high availability, auditability & governance, its application would curtail Non-Performing Asset (NPA), impending frauds and political interference. Banking & Financial Services Industries (BFSI) would never be the same again with blockchain’s approach to inclusivity and quality, reducing operational overheads, commissions/fees while increasing profitability and earnings per share (EPS), eventually winning shareholders’ loyalties. In summary, blockchain could significantly add value through disintermediation; however, its adoption timeline could be longer.

Are Investment Banks Jittery About Blockchain?

Unlike any other industry, which gets affected by the recession, top US banks, except Lehman Brothers, have always remained amongst the top despite multiple recessions impacting everybody else. The reason is simple – banks have primarily made money in capital markets by being sole intermediaries – something no one else has a license to. For instance: the top 10 investment banks alone charge nearly USD100 billion in annual fee income (Indian data is not entirely available: Link).

Source: Financial Times League Table

Once Blockchain becomes mainstream, many revenues generating activities of investment banks will be performed by others – curtailing their hegemonies & steady revenue streams.

Blockchain Key Use Cases For BFSI

Source: Capgemini

Smaller firms & startups realize that funding through ICO (Initial Coin Offering) improves their profitability, given extra ordinary fees (7-10%) of these banks. Given its potential, blockchain will get adopted with time.

Could Blockchain Be the Next Gamechanger?

Most likely ‘a Yes’. Let us take a hypothetical example of a mid-size bank in an emerging economy (say Axis Bank in India). Axis Bank reported a basic EPS (earning per share) of INR 1.13 in FY 17-18. Had it implemented Blockchain for a mere KYC (Know Your Customers), it would have given its shareholders an EPS ranging from INR 5.82 to INR 20.95 (415% to 1754% return) despite a spike in its NPA – this could have made it a favorite at Dalal Street (India’s Wall Street).

KYC on Blockchain (Axis Bank Case Study – hypothetical illustration)

Axis Bank acquired Freecharge in 2017. The acquisition brought 5.4 crore Freecharge customers to the existing 2 crore customer base. Assuming 50% of Freecharge customers (i.e. 2.7 crores) & Axis Bank customers (i.e. 1 crore) needed KYC, Axis Bank must have had to do KYC for total of 3.7 crore customers. Let us examine the cost-benefit analysis of doing KYC on Blockchain. Average KYC cost (without Aadhar) to the bank is INR 1000 (Source) while KYC cost on Blockchain is less than US$ 5 (Source) & as per RBI (Central Bank), KYC is mandatory every 2 years for highly risky/leveraged customers in current economic/job scenario.

The questions are: if you were an Axis Bank shareholder, would you not be convinced that the bank needed to press ‘KYC on Blockchain’ competitive lever to attain such cost arbitrage amidst its rising NPA concerns? Second: if you were an entrepreneur, wouldn’t you once consider ‘KYC on blockchain as a Service’ potentially enticing? Most importantly, if 15 such Indian banks implement Blockchain, would it not easily create ample wealth to astronomically shoot GDP, disposable income, consumption levels and India’s growth rate?

The Puppets (PSU Banks CEOs) & The Genesis of India’s NPA

The onset of telephone banking in India began much before it did in the developed world & PSU Bank CEOs were mere puppets as the NPA game unfolded.

For the first 60 years post-independence (1947 to 2008), India’s public-sector (PSU) banks disbursed loans worth INR 18,000 lakh crores. Surprisingly, in just the next 6 years (2008 – 2014), they disbursed loans worth INR 52,000 lakh crores (almost 3 times of what had been sanctioned in 60 years was sanctioned in mere 6 years) – mostly at someone’s behest, mostly over mere phone calls (i.e. ‘telephone banking’) & mostly without much due diligence.

(Source: Honorable PM Mr. Narendra Modi’s speech rejecting No Confidence Motion against his Govt. at the Indian Parliament – July 20, 2018)

Why did this figure rise so astronomically in just 6 years?

Many of the initial loans had remained unpaid over the years & when time came to repay those loans, new loans were merely sanctioned just to close the earlier ones.

Source: The Economic Times

By budging to political pressures, these CEOs destroyed India’s financial prowess & their banks got grappled with daunting NPAs challenges. As most of these leaders are nearing their retirement age, they leave behind them legacies that they themselves would never be proud of.

Would Merging State-Run Banks (Vijaya Bank, Dena Bank & Bank of Baroda) Help?

This might not sound plausible. Both Dena Bank & Vijaya Bank don’t have a global presence – something Bank of Baroda complements with operations across 24 countries. However, would this merger curb the current NPA mess, the onslaught of potential Nirav Modis (i.e. frauds) and the never-ending political duress?

The question is: ‘Is there a way out?’

Can technology sturdily address these challenges while letting PSU banks CEOs craft legacies that they dearly would wish to?

Addressing NPA, Frauds, Inefficiencies & Political Interferences the Blockchain Way: Case Study — Punjab National Bank (PNB)

How Blockchain Could Have Averted India’s NPA, PNB Scam & Political Interference?

Once the blockchain smart contract is properly defined, it wouldn’t let anyone sanction loan to the defaulter, to customer with poor KYC/CIBIL score, or to customer who hasn’t undergone adequate due diligence, whatever be the political pressure.

- Letters of Understanding (LOU) details long with payment made against each LOU would have got propagated in real-time to all stakeholders (branch, head office & overseas associates).

- Given SWIFT messaging wasn’t integrated with the core banking system (CBS), smart contracts or hyperledger would have flagged this.

- Scamsters couldn’t have repeatedly tampered regulatory compliance records (e.g. KYC) and gone unnoticed.

- All transactions would have been transparent — something none would have been able to modify without consensus from others on PNB blockchain.

In summary, Blockchain could help combat fraud, NPA, inefficiencies & undue political duress.

Demystifying Blockchain

Source: bitsonblocks.net

A blockchain is analogous to a book. Each page, in a book, is like a block and is connected sequentially to the other by a number. Whenever a page gets tampered or torn, it gets easily identified. The same analogy holds, for blocks, in a Blockchain. Like legal contracts bring enforcement in the real world, Ethereum smart contract or hyperledger bring instantaneous facilitation, execution and enforcement of a negotiation/agreement in a blockchain.

Why Blockchain Suits BFSI?

Because of its inherent advantages (trustless/disintermediation, confidentiality, robustness, high availability & verifiability/auditability), blockchain has immense applications in BFSI.

Killer Applications

I. Trade Finance (Supply Chain)

90% of goods in global trade are carried by ocean shipping industry. As per Maersk, a shipment from East Africa to Europe goes through 200 different interactions/communications amongst network of shippers, freight forwarders, ocean carriers, ports and customs authorities. Blockchain has potential to vastly reduce the cost and complexity of trading by establishing transparency among parties and by reducing frauds, errors, transit times, inventory mis-management, wastage and cost while streamlining prompt vendor settlements.

II. International Fund Transfer (Payment)

Conventional overseas fund transfer is not helpful in a dire medical emergencies. If one wants to transfer funds overseas, he/she ends up paying substantial commission albeit the money reaches after 3 working days.

International Fund Transfer using Blockchain

SHARE

RECENT POSTS

-

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR -

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR -

Emerge 2020 HR Tech Summit12 Jul 2020 PR

Emerge 2020 HR Tech Summit12 Jul 2020 PR -

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles -

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Architecting Cyber Security

Architecting Cyber Security

Author - Vijay Kumar, Founder of DigitalFort

Corona Spiking Cyber Attacks?

After having decimated humans and animals internationally, the virulent corona has made inroads across the firewalls, the intrusion detection/prevention systems and the de-militarised zones(DMZ). Don’t get bogged down by these jargons, but the fact is hackers have been super active during the ongoing flu season. Cyber attacks have surprisingly spiked. Just recently, World Health Organization (WHO) was attacked (Source: Forbes) and such trends have increasingly been lately seen across many countries. In Italy alone, cyber attacks have increased by 200% during Corona regime.

Image: Corona & a specific cyber attack (Source: threatpost.com)

As per CSO Business Report,

- There is a hacker attack every 39 seconds.

- In 2018, hackers stole 0.5B personal records and over 75% of the healthcare industry was infected with malware in 2018-19.

- Most companies take nearly 6 months to detect a data breach.

- 95% of cybersecurity breaches are due to human error.

- Cybercrime damage costs would hit $6 trillion annually by 2021.

Security attacks dent not only an enterprise image but also it’s competitive positioning. As a result, enterprise security businesses are evolving like never before. Today there are more than 500 companies alone in cybersecurity space; there was hardly a handful a decade ago (Source).

No doubt, these firms help us become secure. However, implementing & continuously upgrading such solutions come at a cost. For an SME (Small & Medium Enterprise), this means an increase in the cost of operations and a dent in profitability. So, what should these firms do if they want to enhance security quotient in their application/product without having to spend too much on such solutions? The answer is obvious: build security in their offerings. But how? Let us delve onto one such idea – something not so commonly talked about.

Architecting Security: A Perspective on Software Dependencies

A software application relies on dependencies. A dependency arises at different times: it could arise either during system startup, application startup or during application execution/run time. Dependencies could be with libraries, third parties, registry keys (windows), configuration files (Unix), some expected inputs formats (from I/O operations or from user interfaces), required memory size, disk space usage or network availability.

Just imagine the scenario when one of these dependencies starts giving up – would your application still be reliable? Would it continue to behave the same way it is meant to be? And most importantly, how would you ensure that all dependencies that your application relies upon remain available, intact, robust & most importantly – “secure”?

At times & because of constraints (time, resource, cost, experience, etc.), these potential outcomes may not be considered during application design, leading to dreaded un-handled exceptions. Such dependency failures could take many forms: from application crashes to sensitive data (e.g. passwords) being dumped on to screen or on to some file. In the pursuit to identify such design flaws, attackers/hackers target such vulnerabilities & the exact time these dependencies get called. Once their research is done, they plan & execute such attacks.

So, what should we do to circumvent such malicious intent from these hackers

- Identify all your application dependencies. The more legacy the application, the more likely the vulnerability.

- Take a closer look at the time of usage of such dependencies.

- Now try to block usage of such dependencies (e.g. dll, api) as & when they get called.

- Now see how your application behaves in such deprived conditions.

- Most of the time, you would notice that application crashes or sensitive data (e.g. passwords) get dumped on to screen or onto some temporary file.

Let this be food for thought as you architect your next application. At the same time, could this be a lever for your Competitive Advantage? Absolutely, yes. Show how your competitor’s application crashes and how yours doesn’t? This could be a good enough reason to win the First Movers Advantage as you design your next software application.

Author: Vijay Kumar is the Founder of DigitalFort Technologies.

RECENT POSTS

-

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR -

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR -

Emerge 2020 HR Tech Summit12 Jul 2020 PR

Emerge 2020 HR Tech Summit12 Jul 2020 PR -

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles -

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

5 common misconceptions about DevOps

5 Common misconceptions about devops

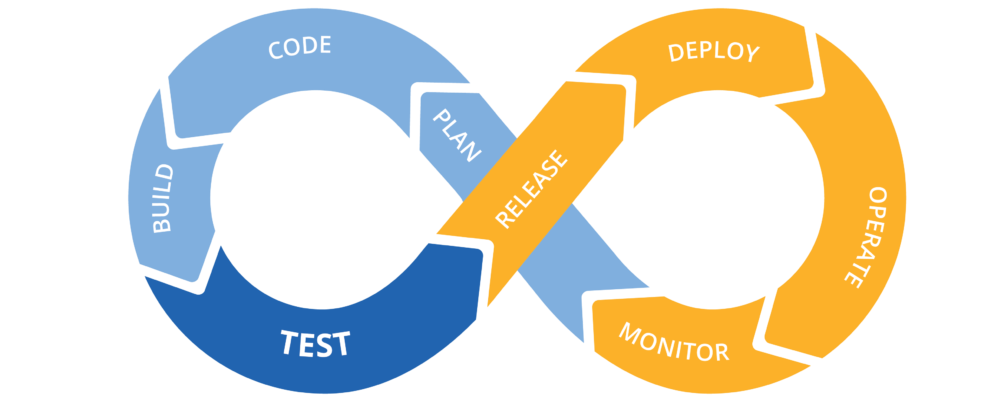

DevOps is a transformative operational concept designed to help the development and production team coordinate operations more effectively and efficiently. In theory, DevOps software is designed to be more focused on cultural changes that stimulate collaboration and efficiency, but the focus often ends up being placed on daily tasks, distracting organizations from the major core principles – and value – that DevOps is built around.

This has even led to many technology professionals developing misconceptions about DevOps because they have been part of the deployments- or know people who have been involved in DevOps plans – that strayed from the core principles of the movement.

This struggle is understandable. Some of the cultural changes are abstract measures that, when delivered effectively, lead to process innovation and significant value creation. That is the aim of DevOps. Moreover, not everybody will buy into cultural adjustments and be comfortable with the idea of adjusting how they work. This even leads organisations to respond with strict procedural guidelines that sometimes detract from the results of movements like DevOps.

So, here are some of the common misconceptions that emerge from this kind of environment include:

- DevOps Doesn’t Work With ITIL Models

The IT infrastructure library creates seemingly rigid best practices to help organizations create stable, controllable IT operations. DevOps is built around creating a continual delivery environment by breaking down the longstanding operational silos. It would even seem that these two principles are contradictory, but ITIL gets a lot of bad press that it does not deserve. The truth is that ITIL features lifecycle management principles that align naturally with what organizations are trying to achieve through DevOps.

- ITIL is too Rigid for DevOps

The core process models of DevOps can work easily, but some people think that even if you can make the marriage work, it will fall apart because ITIL is so rigid, and DevOps focuses on giving users the flexibility to work in whichever way works best for them. There may be some of the major conflict here, but ITIL has been changing in recent years.

- DevOps Emphasizes Continuous Change

There is no way around it; you will need to deal with more change and release tasks when integrating DevOps principle into your operations, the focus is placed heavily on accelerating deployment via development and operations integration after all. This perception comes out of DevOp’s initial popularity among web app developers. DevOps for Dummies explained that most businesses will not face the change that is so frequent, and do not need to worry about continuous change deployment just because they are supporting DevOps.

- DevOps Forces Developers to Bailout Operations Teams

This misconception is often the result of the DevOps deployments that don’t go so well. If your DevOps tools end up building down to production teams complaining that an app is causing compatibility issues and needs to be changed, you are not really doing DevOps correctly. The goal is to get both teams to work constructively to build applications with the production, configuration in mind, and bring development-related knowledge into the final push to release.

- DevOps Eliminates Traditional IT Roles

If in your environment of DevOps, your developers suddenly need to be good system admins, change managers, and database analysts, something went wrong. DevOps, as a movement help to eliminates traditional IT roles, will put too much strain on workers. The objective is to break down collaboration barriers, not ask your Developers to do everything. Specialized skills play a major role in effective support operations, and traditional roles are valuable in DevOps.

RECENT POSTS

-

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR

Clavent’s Emerge 2020 Martech Summit Goes Virtual, powered by CleverTap08 Sep 2020 PR -

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR

Emerge 2020 HR Tech Summit Concluded Successfully12 Jul 2020 PR -

Emerge 2020 HR Tech Summit12 Jul 2020 PR

Emerge 2020 HR Tech Summit12 Jul 2020 PR -

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles

My Experience Attending "How to Build High Performing Teams?" - Workshop On How to be a Good Manager.12 May 2020 Authored Articles -

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles

Top Quantum Computing Companies to look out for in 202029 Apr 2020 Listicles